The Lending Platform Built for Healthcare

clinics

When Banks Say No, Lyyvora Says Yes. From clinics to med-spas, we make growth simple with fast applications, multiple offers, and lenders who listen.

When Banks Say No, Lyyvora Says Yes. From clinics to med-spas, we make growth simple with fast applications, multiple offers, and lenders who listen.

Trusted network ready to fund

Capital access with multiple lenders

Focused Healthcare market

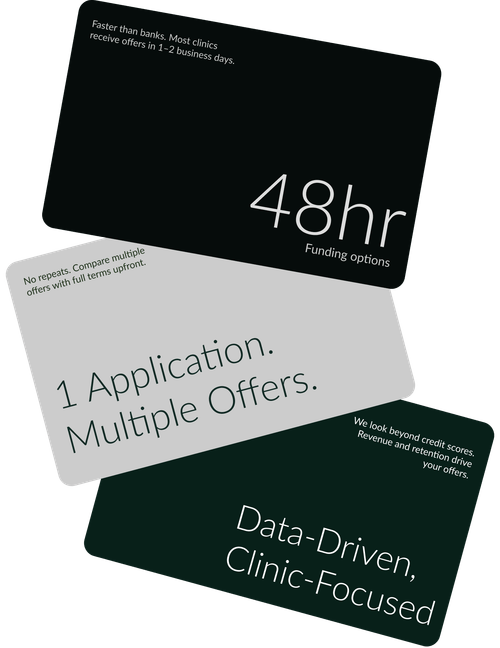

Securely link your business bank account and enter a few clinic details. No hard credit pull, no paperwork just bank-level encryption and a two-minute setup.

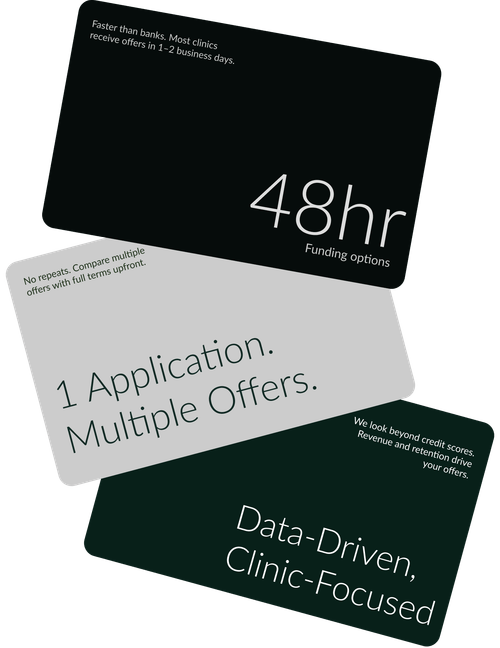

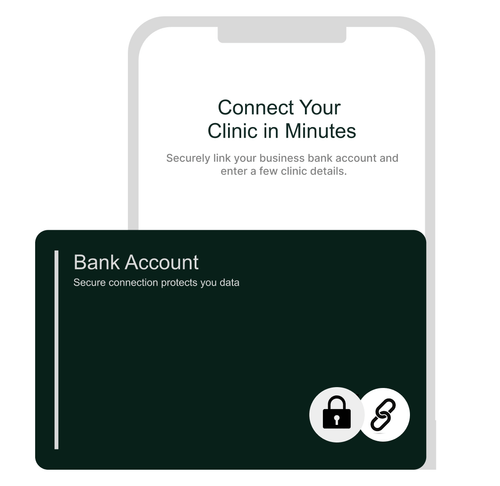

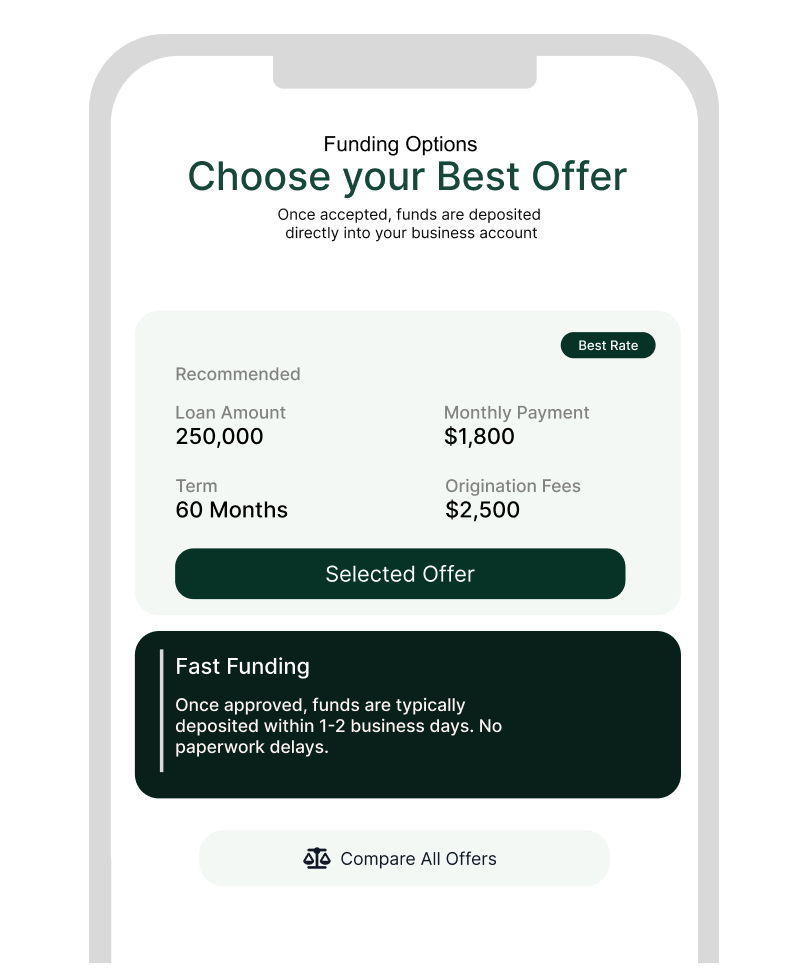

Our lender network reviews your real time revenue. Not just credit scores and delivers funding options with full transparency. See terms, rates, and fees clearly before choosing what fits your clinic’s needs.

Choose the offer that aligns with your growth goals. Once accepted, funds are deposited directly into your business account often within one to two business days. No paperwork. No unnecessary delays or other hussles.

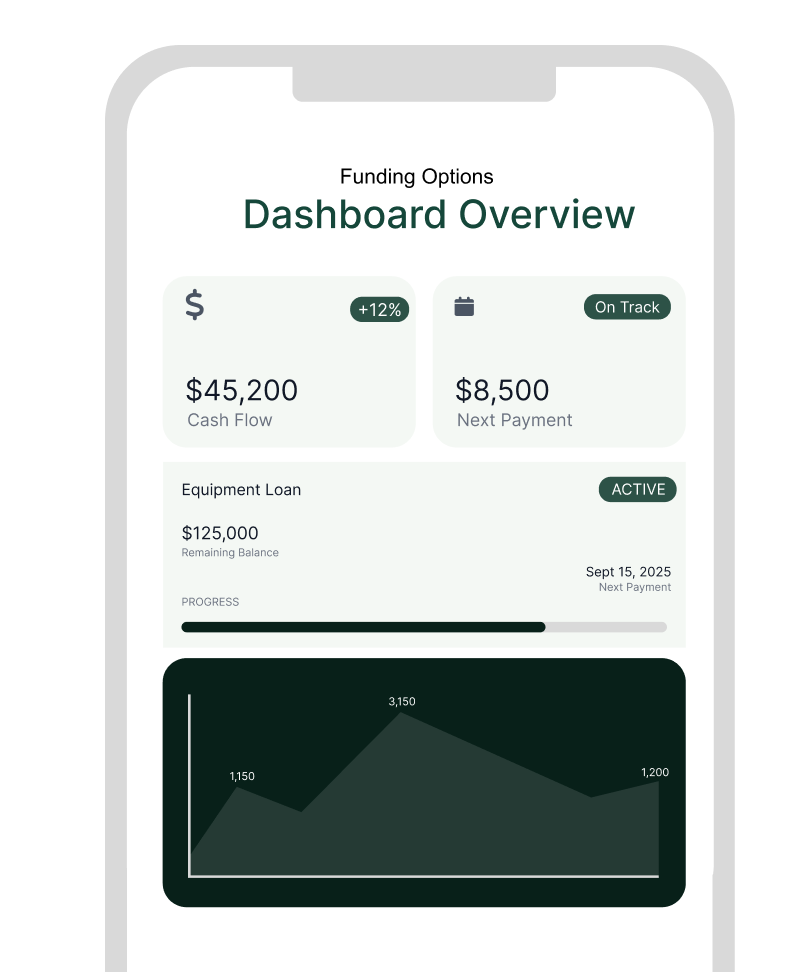

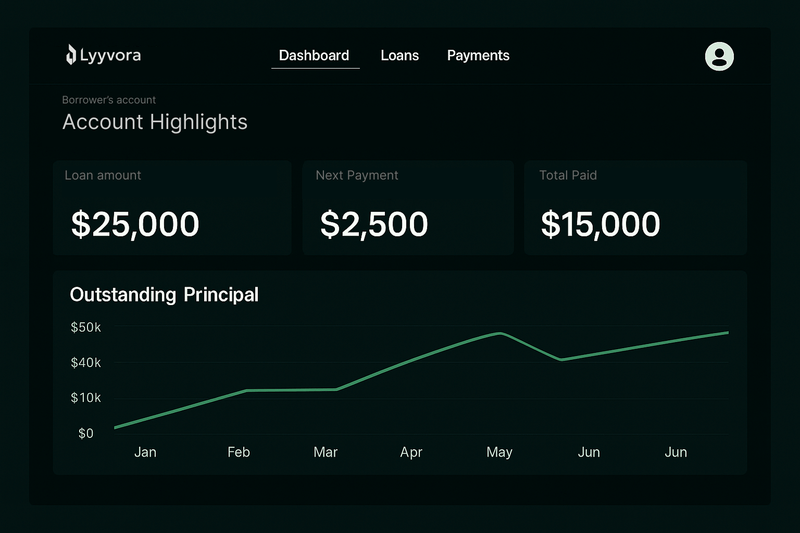

Track your repayments, cash flow, clinic performance, and key metrics from a single dashboard. With real-time insights, you’ll stay ahead of risks, plan for growth, and be ready for your next expansion.

We partner with healthcare businesses to understand revenue cycles, common funding needs to expand, hiring needs... etc

We partner with healthcare businesses to understand revenue cycles, common funding needs to expand, hiring needs... etc

Fast decisions and funding! Typically within 2–5 business days

Why Traditional Funding Fails Businesses

Most clinics specially woman owned don’t have assets to pledge and banks aren’t flexible.

Approval takes months, and criteria are hard to meet for small practices.

They want tech-scale returns — not steady (but growing), service-based businesses.

Standard loan products don’t reflect the realities of running a woman-led healthcare business.

Without access to flexible working capital, women entrepreneurs often scale slower than they deserve.

We go beyond faster approvals. Lyyvora connects you with an ecosystem of partners who support healthcare businesses at every stage of growth.

We protect your data with bank-level encryption and never sell it. Your clinic, your story, your control.

Our AI-powered platform connects to your business’s systems and analyzes real-time data to unlock the best funding options.

From first click to funding, you’ll talk to real humans who understand the challenges of running a woman-owned healthcare business.

Join Lyvvora’s network of lending partners and connect with woman entrepreneurs in healthcare actively seeking capital. Backed by real-time revenue insights and performance data.

We start with women-owned healthcare businesses, and as we expand, our platform will unlock lending opportunities across other service-based industries ensuring your pipeline keeps growing with us.

When banks take 4–12 weeks to decide

No more 1-lender, 1-offer limits

While others stay manual and outdated